kupidon-yar.ru

Community

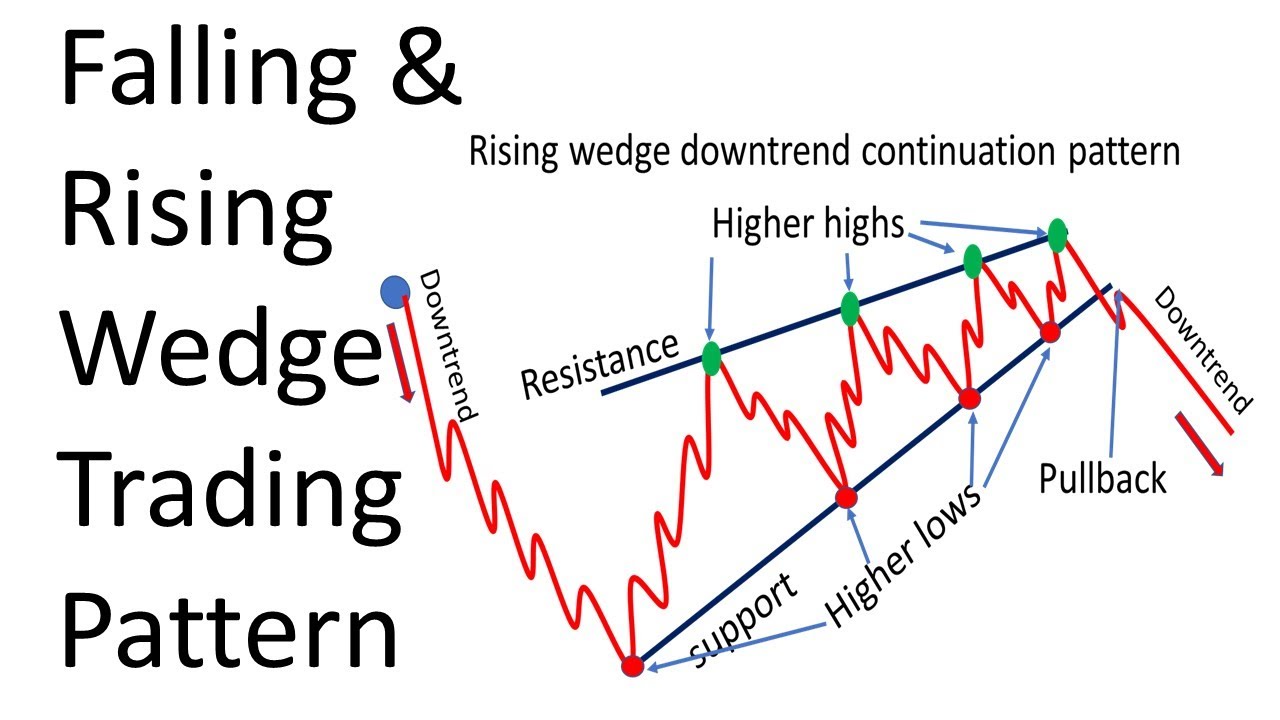

Rising Wedge Pattern

A rising wedge is a bearish stock pattern that begins wide at the bottom and contracts as trading range narrows and the prices move higher. The rising wedge is a bearish pattern and the inverse version of the falling wedge. Both trend lines are sloping up with a narrowing channel up trend. A rising wedge is a chart pattern in technical analysis, characterized by two rising trend lines running in the same direction but with different slopes. Understanding the Rising Wedge Pattern. The rising wedge pattern is a popular chart pattern among traders that can provide valuable insights into future price. There are stock chart with pattern marking. Rising Wedge Pattern (-) Green and Red: Bearish Continuation Chart Patterns - Technical Analysis. Rising Wedge. A Rising Wedge (Ascending Wedge) is a bearish pattern that usually marks a reversal in an uptrend. In a downtrend, the Rising Wedge is considered as a. The converging trend lines of the rising wedge pattern indicate indecision in the market sentiment as the buying and selling are equalised. The indecision is. The Rising Wedge pattern resembles the Ascending Triangle: both patterns are defined by two lines drawn through peaks and bottoms, the latter headed upward. Wedges are a common type of chart pattern that help traders to identify potential trends and reversals on a trading chart. Learn how to trade wedge. A rising wedge is a bearish stock pattern that begins wide at the bottom and contracts as trading range narrows and the prices move higher. The rising wedge is a bearish pattern and the inverse version of the falling wedge. Both trend lines are sloping up with a narrowing channel up trend. A rising wedge is a chart pattern in technical analysis, characterized by two rising trend lines running in the same direction but with different slopes. Understanding the Rising Wedge Pattern. The rising wedge pattern is a popular chart pattern among traders that can provide valuable insights into future price. There are stock chart with pattern marking. Rising Wedge Pattern (-) Green and Red: Bearish Continuation Chart Patterns - Technical Analysis. Rising Wedge. A Rising Wedge (Ascending Wedge) is a bearish pattern that usually marks a reversal in an uptrend. In a downtrend, the Rising Wedge is considered as a. The converging trend lines of the rising wedge pattern indicate indecision in the market sentiment as the buying and selling are equalised. The indecision is. The Rising Wedge pattern resembles the Ascending Triangle: both patterns are defined by two lines drawn through peaks and bottoms, the latter headed upward. Wedges are a common type of chart pattern that help traders to identify potential trends and reversals on a trading chart. Learn how to trade wedge.

The rising wedge is a bearish chart pattern found at the end of an upward trend in financial markets. It suggests a potential reversal in the trend. A rising wedge slopes upward and is most often viewed as a topping pattern where the market eventually breaks to the downside. Understanding the Rising Wedge Pattern. The rising wedge pattern is a popular chart pattern among traders that can provide valuable insights into future price. What is a Rising Wedge Pattern? A Rising Wedge Pattern is formed when two trendlines meet due to the continuously rising prices of two currency pairs. The. Rising wedges are typically considered bearish patterns and often signal the beginning of a downward trend. Falling wedges are usually seen as bullish. The rising wedge pattern is a contracting trading range with an upward tilt. This may be seen by drawing two rising trend lines. Summary · the rising wedge pattern signals a possible selling opportunity either after an uptrend or during an existing downtrend. · the entry (sell order). Rising wedge is a chart pattern with prices bouncing between two up-sloping and converging trendlines. Read for performance statistics, trading tactics. Rising wedges are bearish signals that develop when a trading range narrows over time but features a definitive slope upward. This means that in contrast to. Learn about the bearish rising wedge chart pattern, a powerful tool for day traders. Discover how to identify and trade this pattern, with detailed steps. This pattern is formed by two upward sloping trend lines that are both converging. The pattern is considered bearish because it typically precedes a downward. A Rising Wedge is a bearish chart pattern that's found in a downward trend, and the lines slope up. Wedges can serve as either continuation or reversal patterns. A rising wedge is a technical chart pattern that signals a reversal in a security's price trend. It is formed by drawing two ascending trend lines that converge. The reason he said $1 and $3 is because a risk:reward will be profitable when a pattern only succeeds 40% of the time. Wedges are a common type of chart pattern that help traders to identify potential trends and reversals on a trading chart. Learn how to trade wedge. The rising wedge is a bearish chart pattern found at the end of an upward trend in financial markets. It suggests a potential reversal in the trend. A rising wedge is a chart pattern formed by drawing two ascending trend lines, one representing highs and one representing lows. Rising Wedge. This usually occurs when a security's price has been rising over time, but it can also occur in the midst of a downward trend as well. Rising wedge is a chart pattern with prices bouncing between two up-sloping and converging trendlines. Read for performance statistics, trading tactics. Key Takeaways · The rising wedge pattern shows a possible selling opportunity after an uptrend or an existing downtrend. · The entry, i.e., the sell order, is.

Top Store Credit Cards

Select analyzed the best store credit cards that provide rewards, special financing offers and free shipping perks that make opening a store-specific card. Synchrony Premier World Mastercard® · Capital One Quicksilver Cash Rewards Credit Card · Capital One SavorOne Cash Rewards Credit Card · Citi Custom Cash® Card. Best store credit cards · Target RedCard™ · Walmart Rewards Card · Amazon Prime Store Card · Costco Anywhere Visa® Card by Citi · Lowe's Advantage Card. Target. We present our experts' choices for some of the best store credit cards for bad credit, including online stores, department stores, clothing stores, and big-. While there's no one best credit card for online shopping, there are many good options offering rewards and perks specific to digital storefronts. Store cards are essentially credit cards designed for use at a particular chain of retailers. They will offer you various discounts and other perks. Generally, avoid store cards. There are very few store cards that are worth it. Off the top of my head, Target Red Card, Lowes Card, Citi Sears. With My Best Buy Credit Card, you can earn reward points and finance purchases at Best Buy. My Best Buy Visa Card has the same perks, but you can use it. Target card and Amazon card are two of the best, assuming you have Prime for the latter, though you can just get the Target debit card for the 5. Select analyzed the best store credit cards that provide rewards, special financing offers and free shipping perks that make opening a store-specific card. Synchrony Premier World Mastercard® · Capital One Quicksilver Cash Rewards Credit Card · Capital One SavorOne Cash Rewards Credit Card · Citi Custom Cash® Card. Best store credit cards · Target RedCard™ · Walmart Rewards Card · Amazon Prime Store Card · Costco Anywhere Visa® Card by Citi · Lowe's Advantage Card. Target. We present our experts' choices for some of the best store credit cards for bad credit, including online stores, department stores, clothing stores, and big-. While there's no one best credit card for online shopping, there are many good options offering rewards and perks specific to digital storefronts. Store cards are essentially credit cards designed for use at a particular chain of retailers. They will offer you various discounts and other perks. Generally, avoid store cards. There are very few store cards that are worth it. Off the top of my head, Target Red Card, Lowes Card, Citi Sears. With My Best Buy Credit Card, you can earn reward points and finance purchases at Best Buy. My Best Buy Visa Card has the same perks, but you can use it. Target card and Amazon card are two of the best, assuming you have Prime for the latter, though you can just get the Target debit card for the 5.

Many national retailers like Target, Walmart, and Costco offer store credit cards. Many store credit cards have extremely high-interest rates. You can build. From general purpose Synchrony Mastercards to store cards from brands you love best, find the credit card that works best for you. Apply online today. Some of the best credit cards for shopping earn up to 6% cash back on purchases at major retailers, putting more of your money back in your pocket. A Guide For Retail Workers · Know Your Card. One of the first and most important things I did was get to know my card. · Know Your Customer. Take a minute to. Retail Credit Cards - Reviews · Prime Visa · Capital One Walmart Rewards® Mastercard® · Verizon Visa® Card · Amazon Prime Secured Card · My Best Buy Visa Card. interest charge up to $1; Annual Fee: $0–$59, based on creditworthiness. On approved purchases on the My Best Buy Credit Cards issued by Citibank, N.A. Min. Read our top card reviews · Wells Fargo Active Cash® Card · Citi Custom Cash® Card · Chase Freedom Unlimited® · Capital One SavorOne Cash Rewards Credit Card · Citi®. Build Your Credit While Shopping · Masseys Credit Card · Net First Platinum · Group One Platinum Card · Merit Platinum Card · BOOST Platinum Card · Next. Also known as closed-loop cards, store credit cards are limited to use within the retailer's ecosystem, i.e., on their website or in their stores. On the other. A store card is a credit card that can only be used at a specific retailer or network of retailers, while a conventional credit card can be used anywhere. These cards not only offer lucrative rewards and exclusive perks, but they also open the door to impressive savings with your favourite retailers. Discover it® Cash Back · Blue Cash Preferred® Card from American Express · Citi® Double Cash Card · Chase Sapphire Preferred Credit Card · Capital One. What's a retail store credit card? · Closed loop: These cards, which can only be used to make purchases from one retailer, are by far the most common type of. The best business store cards help your company build credit and save on everyday expenses. Choose one that's most useful to your business. When you open a store credit card, that card can only be used at that store, or in some instances, one or two more sister stores. Some larger retailers offer. The best store credit cards for bad credit are the Montgomery Ward Credit Account and the Amazon Secured Credit Card. Both of these store credit cards accept. Top 5 September store credit cards ; Group One Platinum Card · Vast Platinum · Masseys Credit Card ; Apply for Group One Platinum Card - kupidon-yar.ru Earn cash back on all your purchases with a cash rewards credit card from Bank of America®. See more. In fact, the average store card now charges a record % APR, according to Bankrate's latest retail credit card survey — up from % in and % in. A store card is a credit card that can only be used at a specific retailer or network of retailers, while a conventional credit card can be used anywhere.